Even as Bitcoin futures markets were launched in late 2017 (complete with cryptocurrency primer), and as the Bank of England considers introducing a UK cryptocurrrency, it is instructive to observe the speed at which things develop and evolve, almost on a daily basis. For example, the intense volatility of a major cryptocurrencies such as Bitcoin, with over 50% drop from a peak of almost $20,000 (in Dec 2017) to less than $8000 (in Feb 2018), is actually considered by some to be business as usual.

Blockchain expert, Haydn Jones, at BlockchainHub, suggests that such highs and lows are actually indicative of active trading by buyers and sellers in a robust market. Besides, several other factors may also have exacerbated the huge price movement, e.g.: price manipulation (see allegations against Bitfinex / Tether), opportunistic short selling, tougher regulatory landscape, and even the Chinese / Lunar New Year!

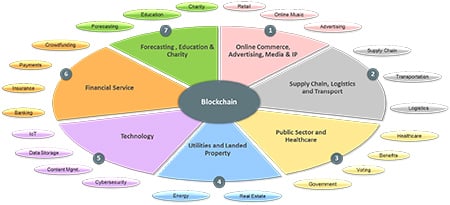

Regardless of ongoing cryptocurrency price fluctuations, the above diagram depicts several key industries and activities which are currently or imminently undergoing, significant disruption by the Blockchain.

According to Blockchain researcher, Bettina Warburg, the Blockchain "provides a shared reality across non-trusting entities" which helps to: reduce uncertainty (via transparency), assure identity (via trust authentication), enforce asset tracking (via auditing) and guarantee execution / delivery (via smart contracts), all powered by mutual mistrust. Therefore, any industry or institution that relies on trusted 3rd party mediation is open to disruption by solutions that remove the need to know or trust the other party in a transaction.

The Blockchain’s distributed, decentralised ledger of immutable transaction blocks is the trust platform upon which such transactions can occur. The successes of Bitcoin, and other cybercurrencies, attest the fact that the Blockchain is indeed the protocol that drives the so called Internet of value. It truly brings to life Professor Niall Ferguson's assertion that "Money is trust inscribed”, even in the digital realm.

So many examples abound of new and pre-existing use cases for cryptocurrencies, smart contracts and DAOs (aka Decentralised Autonomous Organisations). They encompass diverse areas and players too numerous to mention and a recent CBInsights Webinar presentation outlines the use of Blockchain in the enterprise.

The rising star du jour is the use of ICOs (or Initial Coin Offerings) for fund raising, which enables teams to raise sometimes eye watering amounts of money over a short space of time in exchange for coins or utility tokens at the launch of their solution. One recent ICO raised $36 Million in 1 minute! In comparison, you can probably see why the dot com bubble could be considered a sedate walk in the park.

Another emerging trend are faster, more scaleable, and fee-less cryptocurrencies which can be used to facilitate the low value and high velocity / volume transactions needed for the Internet of Things (IoT). These are next generation networks designed to get even faster through-put as the size of the network increases - in true to life network effect. Key players include IOTA, RAIBlocks and the proprietary Hashgraph. However they are all very much bleeding edge propositions, with many questions as yet to be answered.

Several concerns or potential roadblocks on the runaway expansion of the Blockchain, include:

- Increased regulation - There’s a looming threat or promise of tighter intervention by regulatory bodies and governments, especially for ICOs due to their conceptual proximity to the highly regulated securities industry. Other drivers include: reducing tax evasion, fraud, money laundering, anti-terrorism, as well as impact on PII (Personally Identifiable Information) data vs. the right to be forgotten and GDPR.

- Security - Also, many security concerns persist, particularly in light of regular headlines about hacking, outright theft and other malfeasance. Increased Cryptojacking, i.e. the practice of stealing other people’s device processing power to mine cryptocurrency, is also a concern.

- Scalability and fragmentation - it takes significant computing effort to mine Bitcoins, or to verify transactions, which has long raised concerns over its long term performance and scalability. The resulting splits or ‘ forks’ in that cryptocurrency have provided a vast array of competing coins (e.g.: Bitcoin! / Bitcoin XT / Bitcoin Unlimited / Bitcoin Cash / Segwit / Bitcoin Gold). Furthermore, there are myriad cryptocurrency wallets and exchanges to chose from, which can be rather daunting. Also the aforementioned next generation networks which use: Directed Acyclic Graphs (DAG) / voting algorithms / gossip protocols to deliver more flexibility, scale and performance.

- Energy Consumption - Furthermore, the high cost of energy required to mine proof-of-work cryptocurrencies is another growing area of concern as it contributes to the spectre of global warming.

- Privacy - Finally, the early association of Bitcoin with illicit and subversive activities on darknet sites (such as the defunct Silk Road and Alphabay) hasn’t really gone away, especially with the rise of privacy focused cryptocurrencies such as: Monero, Dash, zCash, Verge and DeepOnion. Contrary to popular belief, Bitcoin itself does not guarantee privacy because transactions can be linked to individuals (albeit with some effort), and all Bitcoin transactions are recorded for posterity on a very public Blockchain.

In light of the above opportunities and challenges, it is plain to see that the Blockchain technology is just at the starting line on a lengthy course of disruption and upheavals as yet unimagined. However, in the third and final part of this blogpost series, we’ll take a look at key scenarios and likely outcomes and conclusions after the storm has passed and dust settled.