Gartner’s Gaurav Gupta and Kanishka Chauhan explore the global chip shortage’s origins and discuss future silicon supply trends.

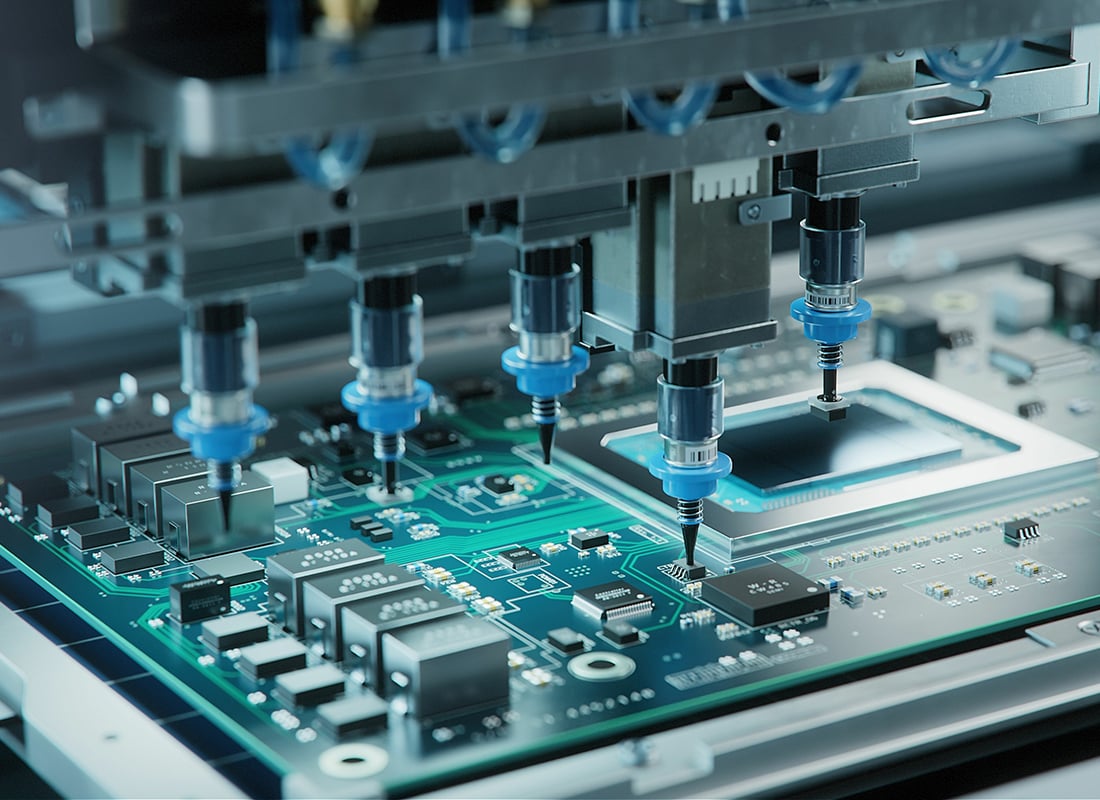

Today silicon chips are used everywhere. From watches to cars; lightbulbs to fridges – everything, these days, has a chip buried somewhere inside it.

But, over the past few years, this trend toward chip filled smart devices has been challenged. That’s because the world has been gripped by a global chip shortage.

In many ways the supply problem, whose origins we’ll explore as you read on, became a global crisis. Beyond making the manufacture of convenience goods harder, the chip shortage also made it more difficult to build devices that look after our health, safety and welfare.

Where, why and how did the global semiconductor shortage start?

GG: A series of events during the pandemic led to the semiconductor shortage situation, but basically it’s a story of higher unprecedented demand and lower supply.

Firstly, COVID-19 led billions of people to work and study from home. So, there was a much higher demand for PCs, laptops and smartphones. Additionally, there was a lot of online activity. Online shopping, online gaming, virtual conferences, Microsoft Teams and Zoom all boomed and this led data centres to expand. Again, this drove demand for semiconductors. So, in short, part of the story is unexpectedly high demand.

Additionally, the pandemic itself drove demand for medical devices and many of these needed silicon chips to work.

Elsewhere, other factors contributed too. For example, 5G had arrived and was being rolled out around the world. This technology requires higher semiconductor content -as for example, power management chips for smartphones.

The US-China trade conflict also played a part. The United States Department of Commerce’s Bureau of Industry and Security (BIS) publishes what’s called its Entity List; people, governments or entities on the Entity List are subject to U.S. license requirements on the export or transfer of specified items, such as some US technologies. Among these entities you’ll find Chinese firms such as Huawei. This led Chinese companies to stock-pile and build inventory.

China’s Semiconductor Manufacturing International Corporation (SMIC), a giant semiconductor foundry or fabricator, was also placed on the Entity List.. This move led many of its customers to shift their orders to Taiwanese foundries and these were already struggling to keep up with global demand.

Additionally, local events like Texas’ winter storm, an earthquake in Japan, logistics issues during the pandemic and fire incidents in fabs have all added to supply disruptions.

On the other hand some sectors, like the automotive industry, have lowered their demand. Homeworking means lower demand for vehicles.

Where is the greatest volume of semiconductor products made and by whom?

GG: Roughly 80% of chip manufacturing capacity is in Asia. Almost 75% is between China, South Korea, Japan, and Taiwan, with the rest being in countries like Singapore and Malaysia. About 20% is with EU and the US - about 8% and 12% respectively.

Some of the biggest chipmakers include: TSMC, Intel, Samsung, SK Hynix, Micron, UMC, GlobalFoundries, and SMIC. Some have facilities in their HQ country only, while others are more globally spread out.

Are all silicon-based components in short supply or are some suffering more than others – CPUs, RAM, SSD? In which product lines are the shortages most acutely felt?

GG: Semiconductor shortages started primarily with devices fabricated on smaller silicon wafer sizes (200nm) and on older, legacy or mature devices. These are things like analog components, used in radios and controllers. Other casualties were power management integrated circuits (PMIC), display drivers, image sensors and metal-oxide-semiconductor field-effect transistors (MOSFET). MOSFETs are used in switching or amplifying signals.

For you

Be part of something bigger, join BCS, The Chartered Institute for IT.

The shortage spread to other devices, like field-programmable gate arrays (FPGA). An FPGA is an integrated circuit designed to be configured by a customer or a designer after manufacturing – hence the term field-programmable.

Memory controllers and microcontrollers (MCU) were also impacted. Logistics issues created shortages even for components such as capacitors and resistors.

Beyond shortages in the supply of components and devices themselves, there was also a shortfall in the materials needed for manufacturing. Specifically silicon slices or substrates (raw silicon wafers) became harder to find.

Elsewhere, lead times for specific pieces of manufacturing equipment used in chips manufacture were extended too. Packaging, for example, is the container that holds the semiconductor die. The machines that looked after this process were hard to find. Similarly wafer fab equipment and assembly equipment became scarce.

Though these shortages weren’t an issue when it came to leading edge devices (those manufactured at 7nm or below), they certainly were for more establish components. Specifically ‘discretes’, and other components, were affected.

Discretes are semi-conductor devices that perform an elementary function and aren’t themselves built of other components. So, things like diodes and transistors are considered to be discrete components.

What lessons have been learned and adaptations made following the COVID-19 pandemic?

GG: Firstly, diversification of manufacturing facilities. There are various examples of companies – such as TSMC, Micron and Intel – expanding fab footprint beyond geographies that they would typically work in.

Next, original equipment manufacturers (OEMs) like Apple, or Hyperscalers like Amazon, and automotive OEMs like Tesla, are now working closely with companies in the chip industry, whether it is foundries, design, or packaging houses.

Indeed, OEMs are making more long-term agreements to guarantee supply (in some cases even pre-payments and co-investments into the chip industry).

How has the shortage progressed and changed over time? What is the supply story like now?

KC: We started to see chip availability becoming a problem in 2020. The situation deteriorated each quarter thereafter. We described this in the Gartner Index of Inventory Semiconductor Supply Chain Tracking (an inventory index).

The semiconductor shortage peaked in 2Q 2021. Since then, the index has been creeping towards normality each quarter, however, it was only in 2Q 2022 that the index finally reached the normal zone.

The chip shortage situation has majorly improved across most end markets, barring industrial and automotive where the strong order backlog is keeping the inventory dry.

The situation with automotive and industrial is also tricky as they depend a lot on legacy chips like analog, discrete, and microcontrollers (MCU). These are the categories where the situation remains a little patchy.

The evaporating consumer demand is mainly responsible for this steep correction in the inventory situation and chip shortage is quickly turning into an oversupply. It is expected that this oversupply will prevail till the end of 2023.

What have been the global consequences of the shortage?

KC: For consumers, price increases. This was felt across all end markets. The prices of all electronic equipment increased by a substantial proportion. People also experience long wait times. Even after paying a higher price, customers had to face long wait times for many products, from smartphones to gaming consoles and even cars.

For manufacturers, we saw a shift in inventory practices. Things like just-in-time inventory and lean inventory took a backseat during the shortage. Most vendors changed their inventory strategies and they seem to be holding higher inventories themselves.

We’re also seeing OEMs, those big hardware manufacturers, now have a higher involvement in the supply chain. This is done to safeguard themselves from any similar situation in the future. Some OEMs co-invested in capacity expansions, others partnered with chip companies with the overall aim to have more control over the supply chain.

We’re also seeing certain products being designed out. To reduce consumption as much as possible, vendors re-designed their products, minimized redundancies, and even removed a few features from their products.

We also need to think about shrinking margins. The increasing semiconductor bill-of-materials forced some OEMs to sacrifice their margins to preserve their market position.

Finally there’s lost market share. Smaller companies, struggling with chip shortages, lost market share to bigger competitors who were able to procure chips.

What are your projections going forward?

KC: Supply has almost returned to normal. We are seeing improvement in lead times across all chip types barring a few.

The ones with longer lead times include analog, discrete, MCUs, and power management integrated circuits (PMIC). Depending on the vendor, the average lead time for analog chips runs between 13 to 52 weeks.

But the good news here is that we don’t expect the lead times to lengthen any further from now on. On the contrary, we expect these lead times to decline and return to their normal level by 3Q 2023 and specifically, for analog chips, as new fab capacity comes online in 2H23.