When my last blockchain / Bitcoin article was published, the cryptocurrency of the day was valued at about $400 per unit, which, at the time, seemed the result of fever pitch speculation and media hype. Fast forward to 2017 and the order of magnitude increase, (at one point clocking up to a 1,300 per cent ROI), appears decidedly hallucinatory.

Such irrational exuberance surely challenges previous examples (such as: the infamous Dutch Tulips, the South Sea bubble or the more recent dot com bubble), for supremacy in foolhardiness, or does it? Despite recent corrections, crypto currency valuations remain high.

The winds of change - key ingredients for the perfect storm

Bitcoin is the first and perhaps most disruptive application of the blockchain, at least for now. Several factors have combined to drive its emergence as a jaw-droppingly speculative investment opportunity, and the underlying blockchain technology is perceived as a revolutionary engine for hyper-charged innovation:

1. Technology drivers:

- According to CBInsights Research, Bitcoin is the first decentralised, censor-proof, portable, secure, durable, and scarce digital asset.

- The blockchain is built on a solid foundation of proven technologies including public key cryptography, hashing and TCP / IP (aka the internet protocols).

- It is one of several disruptive technologies that enable and drive the so-called fourth industrial revolution.

2. Global socio-economic, political and demographic drivers

- Following 2008’s financial meltdown, many institutions, including banks and governments, suffered a major ‘crisis of legitimacy’ which began to erode their traditional role as trusted intermediaries for many transactions.

- Global unemployment, hunger, terrorism, wars, natural disasters and mass migration all highlight and exacerbate inequality, xenophobia, mistrust and dissatisfaction with the status quo.

3. Geometric scale

- The speed and scale of disruption and adoption of blockchain applications is phenomenal, and it challenges existing systems of production, management and governance

These factors contribute to the current frenzied interest in cryptocurrencies and development of new, disruptive applications, business models and emergent behaviours powered by the blockchain.

The eye of the storm - emerging opportunities and challenges

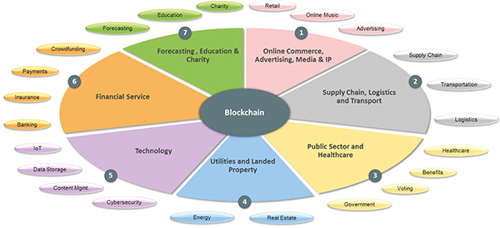

As global futures markets were being launched, and as the Bank of England considered a UK crypto-currency, it is instructive to observe the speed at which things develop and evolve, almost on a daily basis. The diagram below depicts several key industries and activities which have, and are currently or imminently undergoing, significant disruption by the blockchain.

‘Industries undergoing disruption by the blockchain’. Credit: Jude Umeh

Any industry or institution that relies on trusted third-party mediation is open to disruption by solutions that remove the need to know or trust the other party in a transaction. The blockchain’s distributed, decentralised ledger of immutable transaction blocks is the trust platform upon which such transactions can occur.

The successes of Bitcoin, and other cybercurrencies, attest the fact that the blockchain protocol drives the internet of value. It has brought to life Professor Niall Ferguson’s famous assertion that ‘Money is trust inscribed’, even in the digital realm.

Examples abound of new and pre-existing use cases for new cybercurrencies, smart contracts and DAOs (aka decentralised autonomous organisations). However, the star du jour is the burgeoning practice of raising funds via ICOs (or initial coin offerings). This allows start-ups to raise sometimes eye-watering amounts of money over a short space of time in exchange for coins or utility tokens at the launch of their solution. One recent ICO raised $36 million in one minute!

Another emerging trend involves faster, more scalable, and fee-less cryptocurrencies which are even better suited for high velocity / high volume transactions on the internet of things (IoT). These next generation networks are designed to get even faster as the size of the network increases. Key players include IOTA, RAIBlocks and the proprietary HashGraph. However, these are all very much bleeding edge propositions, with many questions as yet unanswered.

Therefore, there are still several concerns and potential roadblocks on the runaway expansion of the blockchain, including:

- Regulation - The threat of intervention by regulatory bodies and governments, particularly for ICOs, due to conceptual proximity to the highly regulated securities industry.

- Security - Security concerns still persist, especially in light of regular headlines about hacking, theft and other malfeasance.

- Scalability and fragmentation - it takes significant computational effort to mine Bitcoins or verify transactions, which raises concerns over long-term performance and scalability, and has resulted in multiple branches or forks on that blockchain, as well as the above mentioned next generation networks which use: DAGs (directed acyclic graphs), voting algorithms or gossip protocols to deliver more flexibility, scale and performance.

- Energy consumption - the energy cost of effort required to mine proof-of-work cryptocurrencies is a growing area of concern for its contribution to global warming.

- Privacy vs. criminality - The rise of privacy-focused cryptocurrencies such as: Monero, Dash, zCash, Verge and DeepOnion raises suspicion of their use for illicit and subversive activities. Contrary to popular belief, Bitcoin does not guarantee privacy as transactions can be linked to individuals.

After the storm - What’s next for the blockchain?

It is clear by now that the blockchain is only just starting its ascendance into every facet of human interaction with machines and with each other. When the dust finally settles, you can be sure that the blockchain will have assumed its rightful place as a key enabler of the fourth industrial revolution.

Moving from fission to fusion

We are currently witnessing what can only be described as a period of explosive innovation, based on, and fuelled by, several emerging technologies. This rapid outward acceleration of disruptive innovation is somewhat akin to nuclear fission, where each disruptive tech sparks further disruption, in a chain reaction, with other disruptive technologies and applications.

However, these pale in comparison with the promise of emerging tech mash-ups with super disruptive potential that is analogous to nuclear fusion. For example, a blockchain-powered artificial general intelligence (AGI) system running an IoT platform will likely usher in such uber-disruptive outcomes. The afore-mentioned 60 second $36M ICO of Singularity.Net’s blockchain powered AI platform, clearly makes it a matter of when, not if, this eventuality will come about.

Demographic expansion

The blockchain seems to be a magnet for diversity, with pools of entrepreneurs, users and disruptive use cases that seem to cut across traditional, stereotypical geo-political, socio-economic, demographic or even academic boundaries.

It also appears agnostic to age, gender, race or religious backgrounds, which is not surprising given the multi-disciplinary roots and influences (incl.: mathematics / psychology / philosophy /cryptography / computing / politics / economy / sociology etc.) required to create useful and successful blockchain applications. However, there’s a lot left still to be done because inequality also represents the greatest societal concern associated with the Fourth Industrial Revolution.

Weathering the storm: ride the wave, avoid the deluge

Some top tips for adapting and leveraging the impending deluge of disruptive innovation (and associated cultural aftershocks) enabled by blockchain, include:

- Education - Get up to speed with blockchain, and other emerging technologies.

- Analyse your own situation - What does blockchain mean for you as an individual, and for your organisation or communities?

- People first - A dash of human compassion and grace will go a long way towards preserving humanity’s values and dignity.

In conclusion, the blockchain will continue to be a fascinating topic for a while yet, but, as more use-cases become reality, it will ultimately go the way of all other great enabling technologies (e.g. paper, printing press, telecommunication and the internet) and become part of the background infrastructure upon which yet more earth shattering innovation will emerge.